Sangoma Technologies (SANG)·Q2 2026 Earnings Summary

Sangoma Posts Record Bookings Quarter, Beats Estimates on Revenue and EBITDA

February 4, 2026 · by Fintool AI Agent

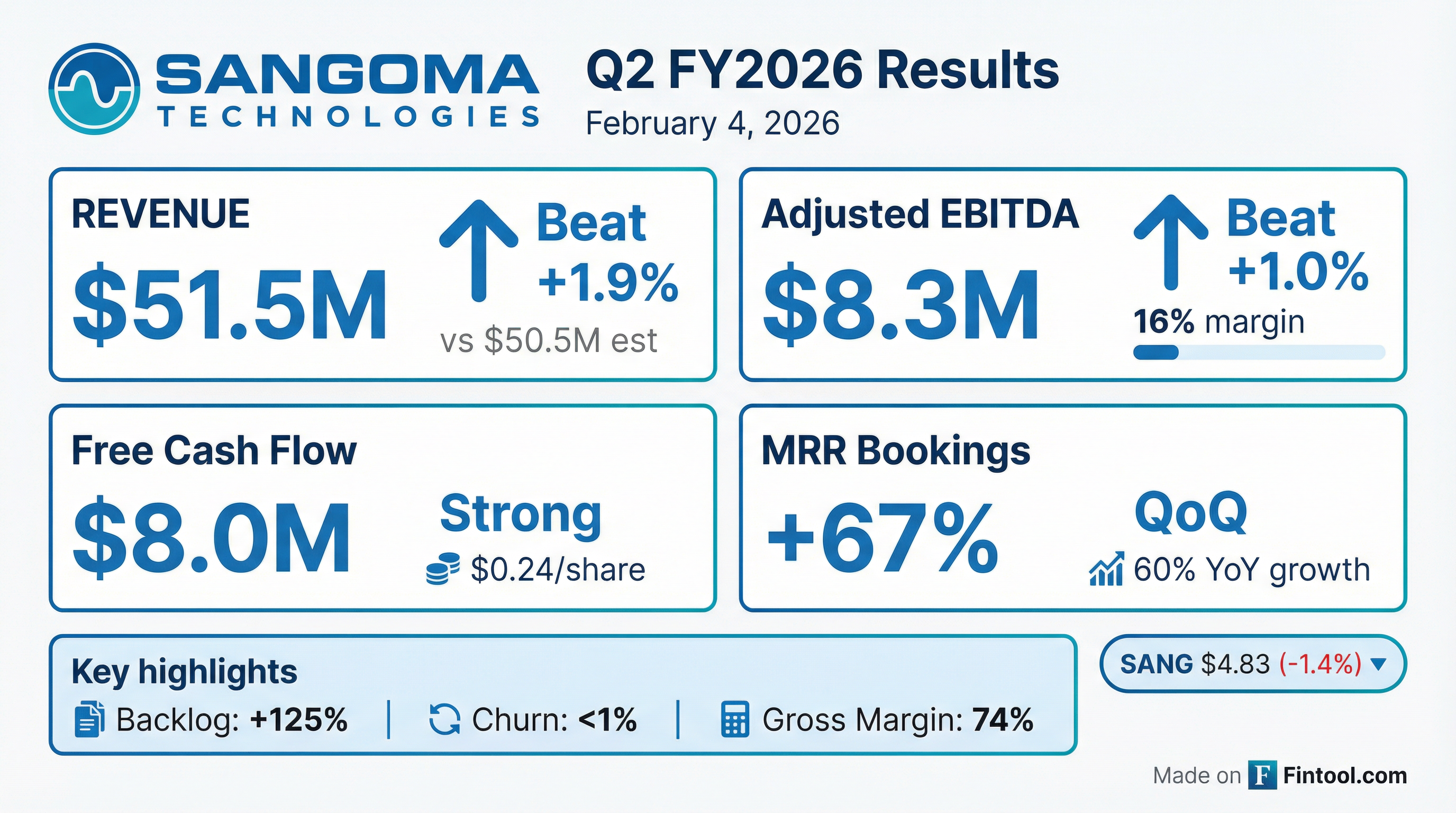

Sangoma Technologies delivered its Q2 FY2026 results that "tracked right to plan," posting one of its strongest booking quarters in recent history . Revenue of $51.5M beat consensus by 1.9%, while adjusted EBITDA of $8.3M exceeded estimates by 1.0%. The real story is the booking momentum—MRR bookings surged 67% sequentially, signaling that the company's mid-market platform strategy is gaining tangible traction .

Did Sangoma Beat Earnings?

Sangoma delivered a modest but clean beat across both top-line and profitability metrics:

*Values retrieved from S&P Global

Service revenue, representing 92% of total revenue, grew 1% sequentially—an important signal that improving bookings momentum is beginning to translate into recurring revenue growth . Gross margin expanded to 74%, up from 72% in Q1 and 68% in the prior year period, reflecting a more favorable revenue mix and continued strength in recurring services .

What's Driving the Booking Surge?

The headline number is the 67% sequential growth in MRR bookings (60% YoY), driven by the company's pivot to larger, more complex mid-market opportunities .

Key wins this quarter:

- $150K+ MRR deal: A large distributed retail customer with 350+ locations consolidating a fragmented communications environment onto Sangoma's platform

- Healthcare wholesale win: ~12K MRR deal supporting two large hospitals and nine urgent care facilities

- Multi-location retail: 18K MRR win from a customer that previously had three separate vendors for voice, access, and managed services

- Comeo partnership: New wholesale SIP trunking contract to support nationwide cloud voice and messaging

The company closed 7.5 of $14.8M in new large strategic deal TCV identified last quarter, bringing total large strategic TCV bookings to $10.8M for H1 FY2026 . CEO Charles Salameh emphasized this represents a fundamental shift: "We never had these size deals before... This is now a new area of business" .

What Did Management Guide?

Sangoma tightened its FY2026 guidance, reflecting increased confidence in second-half execution:

CFO Larry Stock highlighted that the starting backlog for Q3 is up approximately 125% compared to the start of Q2, providing "strong visibility into the second half of the year" .

The company expects sequential revenue growth in Q3 and anticipates returning to year-over-year organic growth once adjusting for the VoIP Supply divestiture .

What Changed From Last Quarter?

Several notable shifts emerged this quarter:

Balance sheet transformation continues: Total debt is now $37.6M, down from $60.4M a year ago—a 38% reduction . The company retired $5.2M in debt during Q2 and continues to return capital via its NCIB, having repurchased 196K shares in the quarter and 700K+ shares (2.1% of outstanding) since launching the program .

Churn improvement: Management disclosed a target of 0.85% churn (vs current 0.96%), with investments in proactive customer retention using AI-driven data models to identify at-risk accounts .

Key Management Quotes

On the strategic shift (CEO Charles Salameh):

"The key point here is that our ability to pursue scale is now an enabler for Sangoma rather than a constraint. The foundational work we completed has positioned Sangoma extremely well."

On M&A opportunities (CEO):

"I've seen this movie three or four times in my career, where the industry offers opportunities, and those who have strong balance sheets and good financial discipline can take advantage of the discontinuities that are occurring... the M&A world is providing that opportunity, as we speak."

On booking sustainability:

"We built the company... to integrate multiple components of essential communications to serve the rising, more sophisticated mid-market... now we have real proof points that validate the thesis, that customers are gonna be buying this way."

How Did the Stock React?

SANG closed at $4.83, down 1.4% on the session, with aftermarket trading at $4.77. Despite the beat and strong bookings, the stock has traded in a range between $4.08 (52-week low) and $7.40 (52-week high), currently sitting below both the 50-day ($5.02) and 200-day ($5.40) moving averages.

The muted reaction may reflect that the beat was modest and the company remains in transformation mode—investors appear to be waiting for the booking momentum to translate into more meaningful revenue acceleration.

Q&A Highlights

On wholesale opportunity (COO Jeremy Wubs): The wholesale channel targets large ecosystem partners—carriers, CLECs, and healthcare networks—who want to monetize their downstream relationships. Sangoma is also capitalizing on customers migrating from legacy soft switch platforms (Cisco BroadSoft, Microsoft/MetaSwitch) who "are looking for something competitive that still held the kind of margin profile they had in the past" .

On AI integration: The company is deploying AI tools in two ways: (1) data models to identify cross-sell/upsell opportunities in the existing customer base, and (2) predictive churn models to proactively retain at-risk accounts .

On deal conversion timing: Large multi-site deals typically take 8-10 months to fully deploy and begin generating revenue, with a "wave upon wave" revenue recognition pattern as prior quarters' bookings continue to roll through .

Forward Catalysts

- Q3 organic growth inflection: First quarter of expected YoY organic growth (ex-VoIP Supply divestiture)

- Large deal pipeline conversion: Additional TCV from the strategic mid-market pipeline built in H1

- M&A optionality: Strong balance sheet ($17M cash, debt down to $37.6M) positions for opportunistic acquisitions as software valuations compress

- Vertical penetration: Focused expansion in healthcare, education, retail, and hospitality verticals

- Churn reduction: Target of 0.85% (vs 0.96% today) would improve LTV economics on larger deal sizes

Historical Performance

*Values retrieved from S&P Global

Note: Q1-Q2 FY26 revenue decline reflects the VoIP Supply divestiture, which removed low-margin, non-recurring resale activity from the revenue base.

This analysis is based on Sangoma's Q2 FY2026 earnings call held on February 4, 2026. For the full transcript, visit Sangoma Q2 FY2026 Transcript.